How to trade the smaller time frame in the market like pro trader

In forex trading selecting the time frame is extremely important since it greatly determines the profit potential in the market. If you look at the professional traders in Singapore then you will notice that all of them are doing a great job in the forex market within a very short period of time since they have spent a good amount of time in learning the art of trading. There are different types of trading strategies in the market and it greatly depends on the traders’ personality. For instance, those who like to trade the smaller time frame in the market is known as a scalper and those who trade the higher time frame is known as long time frame traders. In this article, we will discuss how to trade the smaller time frame like the pro traders in the market.

Fundamental analysis: If you want to become a professional short time frame traders in the market then it’s highly imperative that you do the fundamental analysis. Fundamental analysis is often considered to be the most powerful price driving catalyst in the forex market. If you look at the professional traders in the options trading industry then you will notice that all of them are trading the smaller time frame after doing the fundamental analysis. If you ignore the fundamental analysis in the forex market then you will have a tough time in spotting the market next movement. But learning the art of fundamental analysis in the market is not an easy task rather it is one of the most complex tasks in trading. But if you strong devotion in learning the art of trading then you can access Saxo’s learning academy to enrich your knowledge in the financial industry.

Use the moving average: Moving average is considered to be one of the best in indicators in the forex market. Most of the professional scalper in Singapore using the pending orders on the market at the dynamic support and resistance level using the moving average. If you are involved in options trading then you can easily trade the short time frame by using the moving average trading strategy. The most popular moving average in the forex market is the 100 day and the 200-day moving average. But it’s not like that you will be using the above-mentioned moving average in options trading rather you should try different value and develop your own unique system in the market.

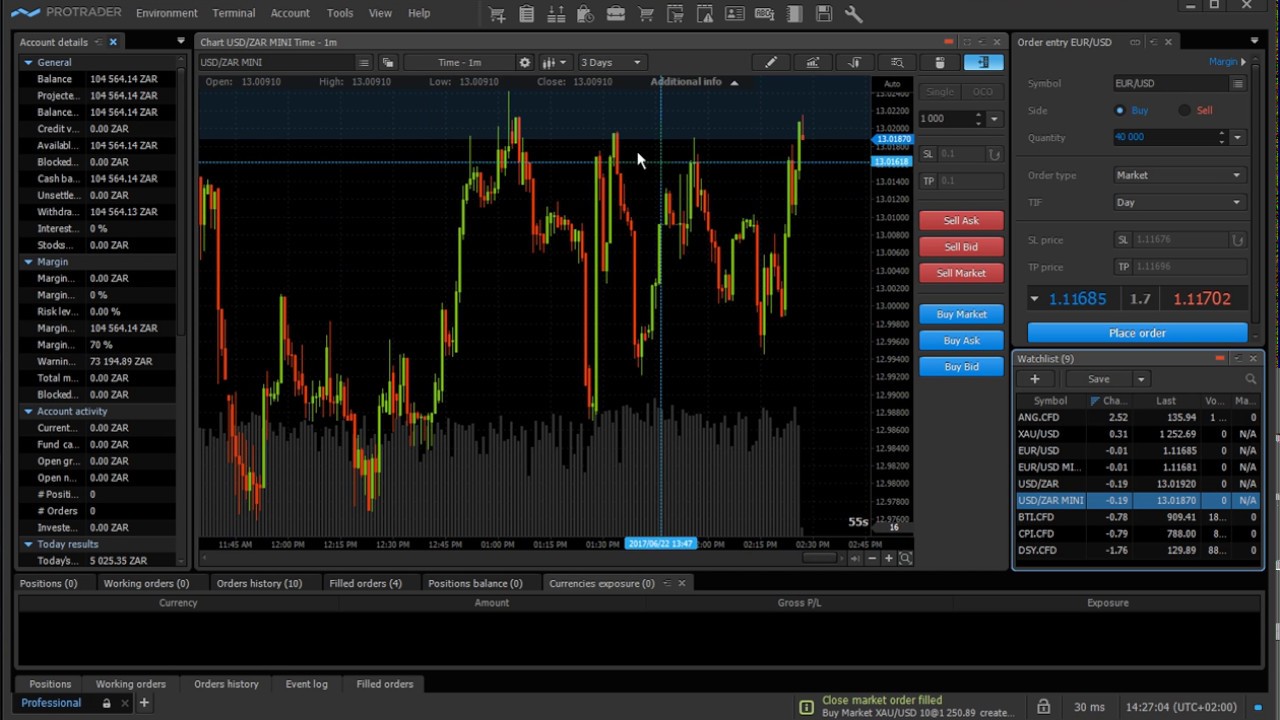

Candlestick pattern: If you want to trade the shorter time frame in the market then its highly imperative that you learn the art of price action trading strategy.in the eyes of trained professional price action trading strategy is often considered to be the most powerful price driving catalyst in the forex market since it allows the traders to trade the market with an extreme level of precision. One of the key reason of in the rising success of the Singaporean traders also lies behind the price action trading strategy. But if you want to become a professional short time frame traders in the market then make sure that you are choosing a reliable broker like Saxo since they offer an excellent professional trading environment to their clients.

Summary: Trading is all about the perfect timing of the setup. If you want to become good at short time frame trading then make sure that you are executing your trades in the market based on the above-mentioned tips. Never trade the market with the money that you can’t afford to lose. Follow risk management factors in every single trade since it’s the key ingredient to becoming a successful trader.